Reverse charge – the shift in tax liability

Generally speaking, when you issue an invoice, VAT is always taken into account. In other words, your client pays the entire sum, which includes value added tax. However, you, as a provider, are not allowed to keep such invoices, but must send them to the revenue office instead. The so-called reverse charge mechanism changes this in such a way that it is not the provider, but rather the beneficiary who takes over this responsibility and subsequently pays tax to the revenue office. What purpose does the reverse charge mechanism serve? Who does it concern, and what is to be considered?

What is a reverse charge?

According to fiscal law, the term ‘reverse charge’ stands for the process of ascribing tax liability to the debtor – more specifically, the VAT liability. Perhaps you have already heard of the terms "debt reversal" or "transfer of tax liabilities". These are simply synonyms for the reverse charge mechanism.

In a normal case | In a reverse charge case |

VAT is settled by the service provider | VAT is settled by the beneficiary |

In practice, this means that the beneficiary settles VAT-related costs on a delivery or service not with the supplier, but rather directly with the revenue office. However, a beneficiary who is entitled to input tax deductions may additionally offset the VAT to be paid in the form of an input tax. In this case, the beneficiary incurs both the VAT and the input tax costs, which then balance each other out.

Aims of the reverse charge mechanism

In practice, a reverse charge simplifies VAT payments (at least on part of the supplier) and reduces the corresponding bureaucratic costs. However, the procedure in question is especially aimed to act against violations such as tax fraud and is known for combatting the so-called ‘missing trader frauds’, whereby tax-free cross-border shipments are used to evade VAT payments. It is estimated that several billion euros are lost per year by this method.

Example: Entrepreneur A supplies goods from France to entrepreneur B in Great Britain. Entrepreneur A issues an invoice without including VAT figures. Entrepreneur B sells the goods from entrepreneur A to entrepreneur C in Great Britain. This time, however, entrepreneur B issues an invoice with relevant VAT figures. The VAT is refunded to entrepreneur C by the revenue office in the form of an input tax. However, instead of paying the VAT to the revenue office, entrepreneur B disappears from the market before the tax is due. From that point on, he is referred to as a ‘missing trader’. Entrepreneur C then sells the goods back to entrepreneur A and the entire process is repeated.

Despite the fact that suppliers do not settle VAT payments in cases of missing trader frauds, they are nevertheless claimed by beneficiaries in the form of input taxes. The reverse charge mechanism prevents from such situations by keeping all VAT and input taxes under one roof. If the recipient wants to receive a refund in the form of input tax from the revenue office, he must also clearly specify the VAT included in the invoice. Since reverse charges make tax systems less susceptible to fraud, many industries nowadays see this procedure as a mandatory part of any transaction. In the past, the construction industry and the suppliers of tablets and mobile phones were very common targets for such fraudulent operations.

When does the reverse charge procedure apply, and who does it concern?

Reverse charges apply to all shipments or services supplied to UK-based companies by suppliers located overseas (also prescribed to some cases of domestic trade). However, the mechanism applies only if the beneficiary is either an entrepreneur or a corporate entity.

Nonetheless, we must ask for what kind of transactions the reverse charge is actually designed. The official website for Her Majesty’s Revenue and Customs services (responsible for the collection of taxes) makes note of goods and services which fall under such category. Generally, all cross-border shipments within the European Union (whether from or to Great Britain) are taken into consideration. However, the website pays particular attention to:

- Mobile phones

- Computer chips

- Wholesale gas

- Wholesale electricity

- Emission allowances

- All wholesale supplies of telecommunications services, including satellite services between counterparties established in the UK

There are several additional exceptions and prerequisites to the reverse charge system.

While keeping in mind that the reverse charge mechanism is applied across all EU countries for the majority of cross-border transactions, there are also various reverse charge regulations, which may differ from one country to another. In other words, deliveries or services covered by the reverse charge in one country may be exempted from the fiscal procedure in question in another country.

Reverse charges also apply to small businesses. You are considered an entrepreneur once you participate in international transactions. This, on the other hand, does not entail any special benefits. It is important to remember that you need a VAT identification number if you operate across the EU. You can simply apply for it on the official website of the UK government.

How do reverse charges appear on invoices? An example

If you are an entrepreneur who provides services tied with the reverse charge mechanism, do not forget to mark them appropriately on invoices.

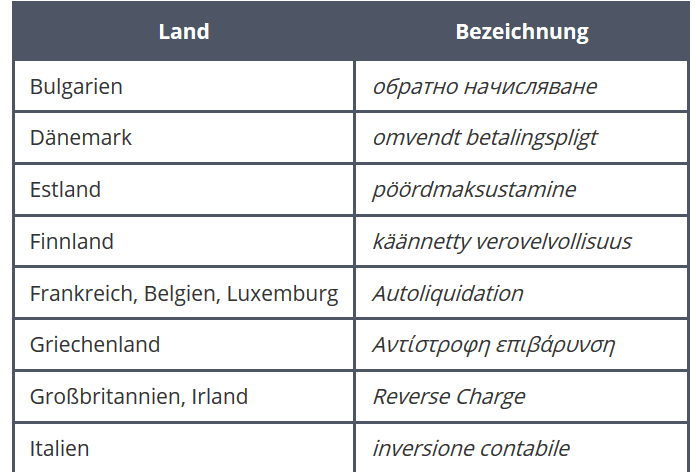

There is no prescribed wording when accounting for transactions involving reverse charges. It is however recommended that you mark them as either ‘VAT due to the recipient’ or ‘recipient is liable for VAT’. You can also note this information by using other European languages (see table below for some examples):

In addition to providing such mandatory information, it is important that invoices issued to other EU countries include the VAT identification number of both the supplier and the beneficiary. When invoicing during the reverse charge procedure, make sure that you do not accidentally disclose the wrong tax figures, which often happens by force of habit.

Microsoft 365 with IONOS!

Experience powerful Exchange email and the latest versions of your favourite Office apps including Word, Excel and PowerPoint on any device!

Summary: reverse charges invert the order of the VAT collection process

Since reverse charge regulations are very extensive, it is no surprise that many entrepreneurs are highly overwhelmed when facing the procedure for the first time. If you have any questions, you can consult a tax advisor to avoid mistakes right from the outset. A lot of hassle can be avoided by sticking closely to the following points:

- Check to see if the regulations apply to your type of business.

- If yes, then the beneficiary must settle VAT-related costs with the revenue office. At the same time, they can be deducted in the form of input taxes.

- Suppliers must issue a net invoice proving the need for a reverse charge procedure to take place.

- Do not forget to clearly indicate this on your invoice. The VAT identification numbers are also important here.

Please note the legal disclaimer relating to this article.