Impairment test: what is it and when is it needed?

The value of certain assets isn’t set in stone: financial disasters, natural catastrophes or extreme market fluctuations can lead to unforeseen economic damages. As soon as an impairment is noticed on one of your accountable properties, you should carry out an impairment test. This makes it possible to conduct an assessment of the capital assets, which is important for making a correct assessment of the company’s value.

What is impairment?

The term 'impairment' refers to the current value of an asset no longer corresponding to its balance sheet amount. This means that the information disclosed in the balance sheet is no longer correct. The company would end up showing the assets as being too high or misrepresenting their actual value. In principle, all assets and liabilities on a balance sheet can be impaired (excluding construction contracts). The impairment for all assets is regulated by the International Accounting Standard 36 (IAS 36). The only exceptions are values that are already regulated by other standards. These include, for example, inventories (IAS 2), construction contacts (IAS 11), (an expected loss on a construction contract should be recognised as an expense as soon as such loss is probable), and financial instruments (IAS 39).

Most company purchases such as machines, vehicles, or IT equipment are generally subject to impairment due to wear and tear. As a result, scheduled depreciation is applied to these items: accountants regularly depreciate an asset from when it is purchased until when it is sold, lost, or scrapped. In addition, accountants also provide an unscheduled depreciation. This can occur both in the case of assets that are depreciated according to plan but are affected by an unexpected loss in value as well as in the case of valuables with an indefinite useful life. You can not write off the latter as planned. In either case, you must first perform an impairment test.

What is the purpose of an impairment test?

Impairment tests are regulated by the IFRS (International Financial Reporting Standards). These are mandatory lowest value tests and their purpose is to determine the actual value of assets. This makes it possible to make a reliable statement about a company’s current assets – this is particularly important for investors. Impairment tests are carried out in accordance with IAS 36 whenever a suspected impairment exists. Indications can be internal as well as external.

Internal indications are, for example:

- Aging

- Physical damages

- When the use of something is less valuable than before due to restructuring

- Profitability is lower than expected

External indications include:

- Declining market value

- Poor economic and financial developments

- Increase in market interest rates

- Falling stock exchange

Intangible assets with an indefinite lifespan and those that are not yet ready for application as well as goodwills must be tested each year for impairment. You can decide yourself when the testing should be carried out but once you’ve chosen a date, you must stick to it every year.

Four fifths of all companies schedule the obligatory impairment test for the balance sheet's deadline date.

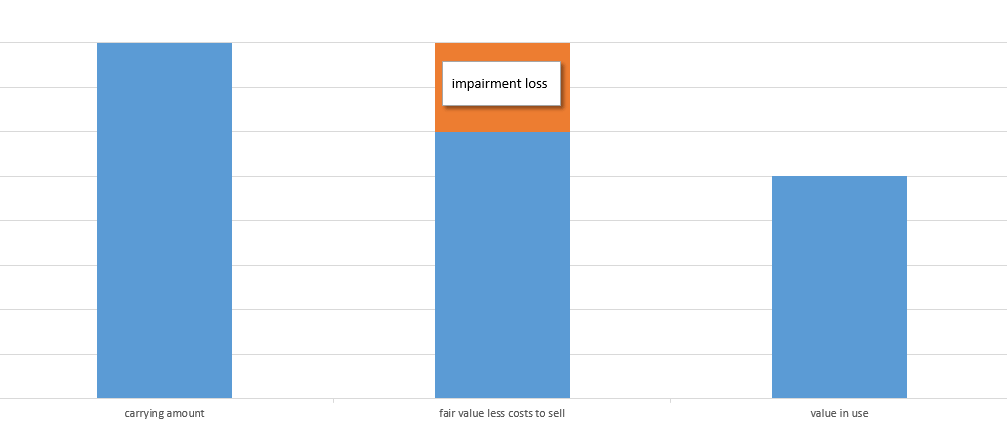

Firstly, you determine the recoverable amount of the asset: this is either the net sale price or the value in use.

- Net sales price: the number of sales generated by a company after the deduction of returns, allowances for damaged or missing good and any discounts allowed.

- Value in use: present value of future cash flows expected to be generated through use.

The higher value out of the two determines the recoverable amount. This value is then compared with the carrying amount. The carrying amount is the value of an asset as reported in the balance sheet.

If the comparison shows that the carrying amount is above the recoverable amount, you have found an impairment. The consequence: a non-scheduled depreciation up to the value of the recoverable amount.

Goodwill impairment test: example invoice

When a company buys up another firm, it pays a purchase price. Before purchasing the buyer must calculate all of the assets (including any assumed debt) that the other company has. This value is likely to be below the purchase price. The difference between the two values is called goodwill. The buyer accepts the difference because they assume that the purchased resources can be used to make a profit. The purchase generates synergies through customer potential, market shares, or profit prospects that aren’t included in the assets. The buyer shows their 'goodwill' during the price negotiation.

In the case of goodwill, a distinction is made between the derivative and the original goodwill. The latter is generated by the company itself rather than through acquisitions and shouldn’t be activated.

A case study example is the company, Albatros, who bought the company, Bravo, for $100 (£78) million. Financial experts from Albatros calculated beforehand that Bravo had an asset value of $60 (£47) million. This means that $40 (£31) million therefore counted as goodwill.

Goodwill appears as an asset in the balance sheet and therefore counts towards the company’s value. However, it is possible that goodwill could lose value within one year. Like certain other intangible assets, goodwill is subject to an annual impairment test. The value, however, does not have an identifiable cash flow and you cannot sell it. For this reason, a valuation level must be defined for the purpose of review, which is called a cash generating unit (CGU). This is directly related to the goodwill and must be consistently selected from settlement period to settlement period (consistency rule). For example, the purchased company, or a department in this company, can be defined as CGU.

Bravo was unfortunately not as successful as hoped. After one year, Albatros realised that the value in use was $70 (£55) million and the net sale price was $80 (£62) million. Compared to the carrying amount of $100 (£78) million ($80 (£62) million asset + $20 (£16) million goodwill), the recoverable amount was $80 (£62) million. Albartos recorded a goodwill impairment of $20 (£16) million.

Now the company has to write off the goodwill in order to adjust the balance to the actual value. In the case of Albatros and Bravo, the goodwill is 100%. If the goodwill is higher than the carrying amount, no appreciation will occur. In this case, the carrying amount stays as it is.

Impairment tests are an important means of making sure a company’s balance sheet is as accurate as possible. Impairment test violations lead to errors on the balance sheet and, therefore, to a false evaluation of the company.

Click here for important legal disclaimers.